Summary and Investment Conclusion

Five separate lawsuits challenging the constitutionality of the individual coverage mandate in the Affordable Cart Act (ACA) have been heard in four federal appeals courts, so far yielding four divergent results (one case remains in the hands of the DC Circuit Court). The Supreme Court has been petitioned to review all four cases, and is likely to review and rule on one or more of the cases in this session, raising the possibility of a ruling in June of 2012

In this call we summarize the 5 most likely candidate cases – any one or a combination of which might be heard by the Court. We focus on the relevant jurisdictional and constitutionality questions, and the related implications for major ACA provisions

We conclude that the Court is highly likely to rule on the ACA by June 2012; that the question of whether the mandate is or is not constitutional is very nearly a coin-toss; and, in the event the mandate is struck down, that limited other ACA provisions also may be struck down, but that ACA is unlikely to be struck down in its entirety

In line with our previous work, we further conclude that the economic relevance of the mandate (i.e. of the related penalty) is less than conventional wisdom (and the framing of many legal and political arguments) might suggest. Congress’ intentions notwithstanding, the penalty is simply too small to have any meaningful influence on the binary question of whether commercial insurance markets, as contemplated in the ACA, experience adverse selection pressures of sufficient magnitude to compel further reforms. We believe these pressures almost certainly come about, and that the individual mandate and penalty are relevant only to the rate at which (but not whether) adverse selection pressures build to critical levels. To illustrate, even if the mandate and penalty remain in place, we project that for subsidy-eligible households, the marginal cost (net of subsidies and penalties) of purchasing health insurance doubles as a percentage of income over the first decade of the full penalty, to a level at least on par with essentials such as food and utilities (and this conservatively assumes all households buy the cheapest available plan). Take away the mandate and penalty, and these pressures simply build faster

We suspect healthcare share prices generally, and HMO and Facilities share prices specifically, will treat the survival or loss of the individual mandate as a fork in the road to either far better (mandate upheld) or far worse (mandate vacated) mid-term earnings prospects. We suspect the true impact of the mandate on earnings potential is considerably more modest. At the risk of looking way too far ahead, we would think in terms of opportunities to trade volatility (agnostic to the direction of share price change) in commercial HMOs and Facilities in the period leading up to an anticipated verdict, and would look for opportunities to bet against the (presumed over-) reaction of commercial HMOs’ and Facilities’ share prices to a known verdict (underweight if the mandate is upheld, overweight if the mandate falls). Other subsectors face unidirectional risks related to the broader question of whether ACA is repealed, and any market tendency to overestimate the likelihood of repeal creates a corresponding directional bet that we would tend to view as attractive. Smaller Medicaid-specific HMOs face a risk of losing beneficial ACA-driven expansions in Medicaid eligibility and funding if ACA is repealed. Conversely, manufacturers of innovative products (drugs, biotech, med tech) face a large relative (to other healthcare subsectors) tax burden that would be alleviated if ACA were repealed. Believing the odds of a full repeal (at least by the Court) are extremely low, we obviously would think in terms of overweighting subsectors that lose from an ACA repeal (such as Medicaid HMOs), and vice versa (such as innovative manufacturers) as June 2012 approaches

When might the Supreme Court hear arguments? The matter of the Anti-Injunction Act

The Anti-Injunction Act (“AIA”) precludes courts from considering cases that seek to “restrain assessment of a tax” before that tax has been enforced. In order to assure the orderly collection of taxes (and prevent federal courts from being tied up with spurious lawsuits to delay payment of a tax pre-enforcement), it prescribes the legal course that taxpayers who intend to challenge a tax must follow: pay the tax, then seek remedy through the courts ex-post. The relevance of the AIA to the jurisdiction of the federal courts to decide the merits of the individual mandate hinges on the “shared responsibility penalty” assessed on those who are required to maintain minimum coverage but do not. If that penalty in fact constitutes a tax, then the federal courts’ hands may be tied until that tax is actually assessed. Since 2014 is the first year of mandated coverage and the penalty is paid as part of the individual tax return, this might preclude a Supreme Court hearing (never mind full resolution) until at least April 15, 2015

In Liberty University v Geithner the 4th Circuit Court became the only appeals court to signal (split) that the AIA did in fact apply, and vacated the district court’s ruling on the merits. The significance of this ruling is not just that it created a division in Circuit Court findings (increasing the likelihood that the Supreme Court will be forced to settle the controversy), but it was also contrary to the positions of both litigants[1]

Obviously the presumption of a definitive resolution to the constitutionality of the mandate and the rest of the ACA inherently also presumes that the court can establish jurisdiction. Two judges on the 4th Circuit (one Clinton nominee; one Obama nominee) are the only federal judges to punt on a health reform case explicitly based on the AIA. Petitions for writ of certiorari filed in Liberty and Florida v US Department of Health and Human Services both present the high court with the question of the applicability of the AIA to this case, but (we believe) only for the purpose of resolving the uncertainty created by the 4th Circuit

Outside of Judge Wynn’s (Obama nominee) concurring opinion on the AIA decision in Liberty, in which he suggests that if the AIA were not in effect he would have upheld the mandate under the Taxing and Spending Clause, there is scant evidence of federal judges being receptive to the general argument that the penalty is in fact a tax. Both the 6th and 11th Circuit Courts unanimously rejected the Taxing and Spending Clause as a justification for the mandate. As in the arguments around applicability of the AIA, much of the conversation hinges on whether there is a distinction between a penalty (e.g. the shared responsibility penalty) and a tax. The overwhelming majority of courts have found that there is, in fact, a difference

Despite the fact that the penalty is assessed based on taxable income, and collected with individual tax filings, Congress specifically chose not to call the penalty a tax. This is a tremendously difficult hurdle for those who would justify the mandate under the Taxing and Spending Clause. Northern Florida District Judge Vinson (Reagan nominee) highlighted in Florida v DHHS, after detailing the legislative history of the ACA and the fact that the word “tax” had appeared in earlier drafts of the bill, “[f]ew principles of statutory construction are more compelling than the proposition that Congress does not intend sub silentio to enact statutory language that it has earlier discarded in favor of other language.”[2]

It is worth noting that Congress might have easily achieved – via de facto taxation – the same ends as the mandate they enacted, and been fully justified under the authority of the Taxing and Spending Clause. Judge Sutton (G.W. Bush nominee) in Thomas More Law Center v Obama suggests “Congress might have raised taxes on everyone in an amount equivalent to the current penalty, then offered credits to those with minimum essential insurance. Or it might have imposed a lower tax rate on people with health insurance than those without it. But Congress did neither of these things, and that makes a difference.”

The near-unanimity of the Circuit and District Courts regarding the lack of authority for the mandate found in the Taxing and Spending Clause makes an AIA-based delay of Supreme Court review seem a remote possibility. Accordingly we do not expect the AIA to delay Supreme Court review of the ACA, and therefore do anticipate a ruling in June 2012

Is the ‘individual mandate’ to purchase coverage constitutional?

Proceeding on the assumption that the penalty is not a tax, and that the AIA does not apply, the matter of whether the individual mandate is or is not constitutional would seem to hinge on the courts’ (and ultimately, the Court’s) interpretation of the Commerce Clause

The Court’s interpretation of Congress’ power to regulate interstate commerce has expanded substantially over the past two centuries. But even considering that expansion, it remains unclear whether Congress has the power to compel citizens to purchase a private good as a condition of lawful residence

As difficult and nuanced as the constitutional arguments both for and against the individual mandate under the Commerce Clause are, the basic premises are actually quite simple. Proponents argue (roughly) that healthcare is clearly under the purview of interstate commerce; that everyone at some point becomes a consumer of healthcare services; that healthcare is a unique good which cannot be denied even to those unable to pay, so the uninsured inflict huge costs on the rest of the population; and that it is thus within Congress’ enumerated powers to regulate how healthcare services are paid for. Opponents of the mandate argue (again, roughly) that those who choose to forego insurance aren’t in the stream of commerce and so cannot be regulated. The Commerce Clause argument was successfully invoked as a basis for Congress’ imposition of the individual mandate (and thus the penalty) in three out of five district court cases that upheld the mandate (Thomas More Law Center; Liberty; Mead v Holder[3]). In both Florida and Virginia v Sebelius, however, district courts found that the individual mandate exceeded Congress’ authority under the Commerce Clause

At the Circuit level, the limits of Congress’ Commerce Clause authority has come in for similarly mixed reviews. The conflicting district court opinions in Thomas More and Florida each were affirmed (by the 6th and 11th Circuits, respectively). Similarly, conflicting district court rulings were dismissed by the 4th Circuit in Liberty (jurisdiction / AIA; see above) and Virginia (standing; the mandate imposes no obligation on the states, thus they cannot sue on behalf on their citizens)

As a broader legal framework, two pairs of Supreme Court cases have generally guided Commerce Clause decisions in the lower courts and steered thinking about the limits of Congressional power: Wickard[4] and Raich[5] each upheld laws passed under the Commerce Clause; conversely Lopez[6] and Morrison[7] each struck down laws passed under the Clause

Wickard questioned whether the Commerce Clause allowed Congress to regulate a farmer who wanted to grow wheat for his own personal consumption above a congressionally set quota. Raich similarly questioned the ability of Congress to extend Commerce Clause authority to an individual growing crops for her own personal use (in this case, medicinal marijuana which she grew legally under California state law). In both cases, the Court upheld Congress’ broad power under the Commerce Clause to regulate economic activity, even though no actual commerce was involved

By contrast, Lopez and Morrison each give insight into the limits of Commerce Clause authority. In Lopez, the Gun-Free School Zone Act (passed under the Commerce Clause) was invalidated because the activity regulated was viewed by the Court as both purely local and noneconomic. Likewise in Morrison, the Court struck down part of the Violence Against Women Act which allowed victims of gender-motivated crimes to sue for civil damages in federal court. Applying its logic from Lopez, the Court in Morrison found that the activity regulated was completely noneconomic, and that “our cases have upheld Commerce Clause regulation of intrastate activity only where that activity is economic in nature.” And, perhaps critical to the framing of the Court’s views on ACA, Congress’ use of a “but-for causal” chain of logic (i.e. victims of violent crime may be deterred from interstate travel and employment, which could reduce national GDP and increase national medical costs) “would allow Congress to regulate any crime as long as the nationwide, aggregated crime has a substantial impact on employment, production, transit, or consumption”; which is problematic since “Congress’ regulatory authority is not without effective bounds”

Whether or not declining to purchase health insurance is an “economic activity” appears absolutely vital to understanding the applicability of the Commerce Clause to the individual mandate. Judge Martin (Carter nominee), writing for the 6th Circuit majority in Thomas More, finds that “[t]he activity of foregoing health insurance and attempting to cover the cost of health care needs by self-insuring is no less economic than the activity of purchasing an insurance plan. Thus, the financing of health care services, and specifically the practice of self-insuring, is economic activity.” In contrast, Judge Dubina (G.H.W. Bush nominee) writing for the 11th Circuit in Florida finds that

“if the decision to forego purchasing a product is deemed “economic activity” (merely because it is inevitable that an individual in the future will consume in a related market), then decisions not to purchase a product would be subject to the sweeping doctrine of aggregation, and such no-purchase decisions of all Americans would fall within the federal commerce power. Consequently, the government could no longer fall back on “uniqueness” as a limiting factor, since Congress could enact purchase mandates no matter how pedestrian the relevant product market”

Clearly the 6th and 11th Circuits – the only Circuits to yet rule on the merits of the individual mandate challenge – could not stand in starker contrast. Handicapping the Supreme Court’s resolution of this controversy is incredibly difficult and perhaps even impossible, though later in this call we attempt to provide some insight into the views of the justices who may be swing votes (i.e. Kennedy)

As an important aside, we recognize that the Court’s definition of what is or is not intrastate economic activity may be framed by variables that lay well beyond the boundaries of classic economics. That said, we think it’s nevertheless useful to consider the relevant economics in a legally and politically agnostic manner. One chain of logic in the ACA, and in some lower court rulings, holds that an individual’s purchase of healthcare is ‘inevitable’; and, by extension that 1) an individual consuming healthcare without insurance will create costs that fall on others; and, 2) these cost effects cross state lines. At the level of the entire national health system – i.e. “on average” – it is plainly true that the costs of care for the uninsured are borne by others. However at the level of the individual, there are – inevitably – exceptions to this rule: there are certainly persons whose lifetime consumption of healthcare can be financed without health insurance[8]. Whether the Court considers the effect of one person choosing to be uninsured on any other person at the individual or whole-system level is thus terribly important – and for the moment we cannot guess which level will apply. To our second point, the notion that the absence of insurance in one state adversely affects the economics of healthcare in another state may overlook, at least in part, the fact that healthcare in large part is locally produced and consumed. Markets for hospital and physician services – the two largest input costs – tend to be very local; and, the costs of caring for the uninsured in one market (e.g. Boston metro) have little (or even no) effect on the costs of hospital and physician services (and thus the price of insurance) in a geographically distinct market (e.g. NYC metro). The moving parts of healthcare costs that routinely cross state boundaries would be the taxes that support federal programs such as Medicare and Medicaid (which are unaffected by the presence or absence of an individual mandate in the private market); and, the cost of inputs to care (e.g. drugs, devices, commodity consumables) that are established in national, rather than local, markets. Having been practitioners and/or students of pricing branded medical products in the US market for decades, we do not believe the presence or lack of insurance in a given local healthcare market has any meaningful bearing (if in fact any at all) on the pricing of these products in geographically distinct (but still US) healthcare markets. To be honest we’re reasonably sure we could find some economic effects stemming from the uninsured in one market that cross state lines into another market[9], however we’re nevertheless convinced that none of these effects – even in sum – are meaningful. Thus here again, the Court’s framing of the interstate question seems critical – against the ‘metaphysical’ standard of whether the individual mandate has any cross state economic effects, regardless of how small, the answer is almost certainly ‘yes’; alternatively, against the standard of whether the individual mandate has meaningful (or even measurable) cross state effects, we believe the answer is almost certainly ‘no’

If the ‘individual mandate’ is unconstitutional, is it also ‘severable’?

If the high court finds the individual mandate constitutional, severability is a moot point. However, if the mandate is invalidated, the question becomes whether any, and if so which, ACA provisions are found non-severable, and thus also invalidated

Here again, the lower court rulings to date are not terribly instructive – while the 11th Circuit in Florida found the mandate to be completely severable from the rest of the ACA, district courts have variously found it to be completely non-severable, or only partially severable

District Judge Vinson, in his finding of complete non-severability in Florida, noted that the government had argued that the individual mandate is “absolutely necessary for the Act’s insurance market reforms to work as intended.” As to whether non-health insurance related provisions are just as non-severable, he argues that if it is Congress’ intention that “the statute is viewed as a carefully-balanced and clockwork-like statutory arrangement comprised of pieces that all work toward one primary legislative goal, and if that goal would be undermined if a central part of the legislation is found to be unconstitutional, then severability is not appropriate”

In rejecting Vinson’s severability finding, the 11th Circuit noted the Supreme Court has historically “declined to invalidate more of a statute than is absolutely necessary.” Based on this presumption of severability, the Circuit fairly easily upheld all of the ACA provisions not directly related to private health insurance markets. Though it spends more time on its reasoning for the health insurance related provisions, the court ultimately finds that the mandate can be severed even from those, based on the Supreme Court’s established two-part severability test (“Unless it is evident that the Legislature would not have enacted those provisions which are within its power, independently of that which is not, the invalid part may be dropped if what is left is fully operative as law”)

The district court in Virginia conceded it was impossible to determine whether or not Congress would have chosen to enact the legislation without the mandate, and so erred on the side of conservatism invalidating only “Section 1501 [the individual mandate] and directly-dependent provisions which make specific reference to Section 1501.” As a practical matter, Section 1501 codifies the mandate and associated penalties through its revision of IRS code (Sec. 5000A), and references to 5000A are numerous and widespread in ACA. However mechanically, we read the ‘linkage’ between 1501 / 5000A and the balance of ACA as being relatively narrow. Specifically, we interpret these sections as tying the mandate to insurance market reforms such as guaranteed issue and the elimination of medical underwriting

In Goudy-Bachman v US Department of Health and Human Services, the district court for Middle Pennsylvania also invalidated the individual mandate and crafted another limited view of severability that is consistent with our narrow interpretation of severability in Virginia.[10] Judge Conner (G.W. Bush nominee) opined that “Congress clearly linked the individual mandate to the guaranteed issue and pre-existing conditions reform provisions because it is a partial funding source for these provisions. Given the current structure of the Act, and with certain deference to the government’s perspective of Congress’s intent, the fate of the guaranteed issue reforms rises and falls with the minimum coverage provision.” This led him to sever the minimum coverage provision along with the guaranteed issue and pre-existing condition provisions, though he allowed the rest of the ACA to stand

It is entirely unclear to us – as a legal matter – whether the Court will find the mandate severable (in the event the mandate is found unconstitutional). However, our (admittedly non-expert) sense of the law, and the precedent, is that a finding of complete non-severability is unlikely. I.e. if the mandate is found to be unconstitutional we see real risks of certain (presumably insurance market related) provisions also being overturned; however we see a complete repeal of ACA as extremely unlikely

Is the ‘individual mandate’ (economically) relevant?

Absent consequences, the mandate to purchase minimum essential coverage can have no substantial impact on households’ decision making. Ignoring the mandate of course does have a consequence, specifically the requirement to pay a penalty, which is the greater of a flat $695 / person (to a max of 3x this value per household) or 2.5% of adjusted gross income. The penalty increases to this level over a 3 year period (the penalty in 2014 is $95) and then inflates at the rate of growth in cost of living

The relevance of the penalty is its impact on the marginal cost of purchasing insurance. Taking the example of a subsidy-eligible household deciding whether to purchase health coverage, the cash cost of purchasing coverage is the dollar cost of premiums, net of the dollar value of subsidies the household receives. However if the household chooses not to purchase insurance it must pay the penalty, and so cannot ‘save’ all of the cash difference between the cost of premiums and the value of subsidies. I.e. if no insurance is purchased, the savings are limited to the difference between the dollar cost of the premium, net of both the dollar value of the subsidy and the dollar cost of the penalty. Thus the effect of the penalty is to reduce the marginal cost of purchasing healthcare insurance, and its effect is additive to the dollar value of any subsidy the household might receive

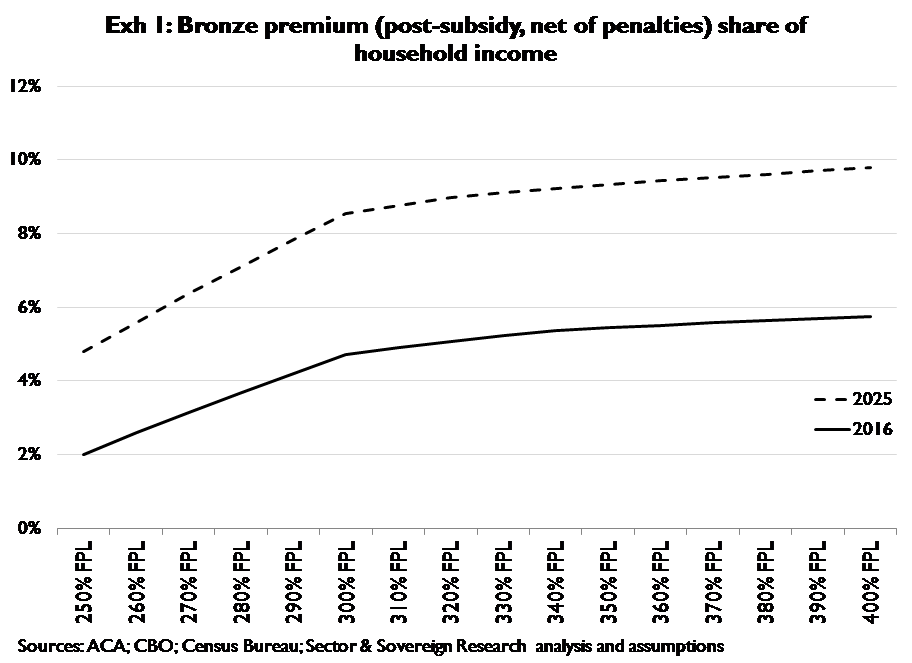

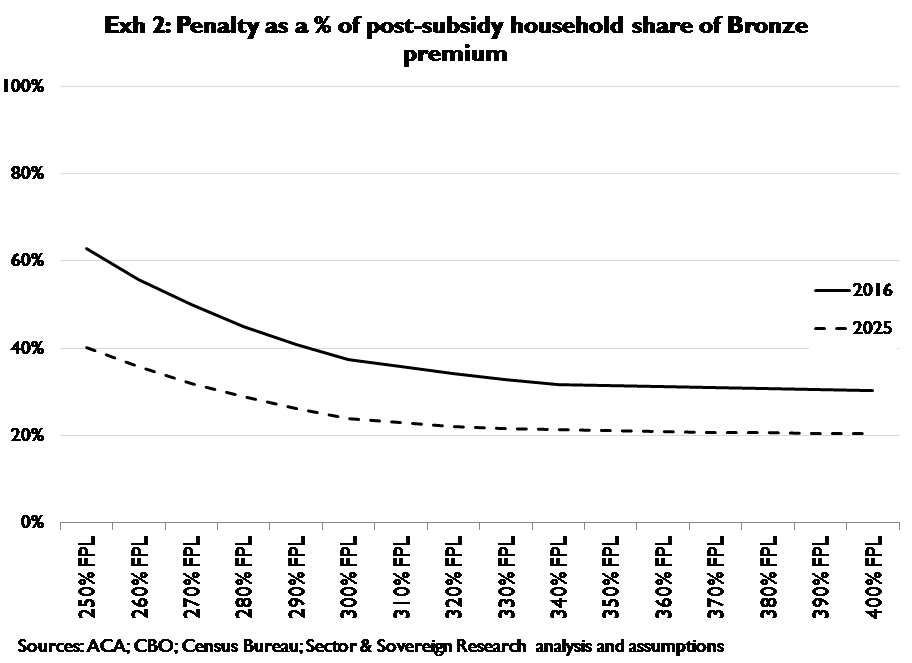

Exhibit 1 shows the marginal cost of buying health insurance for subsidy-eligible households; the y-axis is the marginal cost of purchasing coverage (net of subsidy and penalty) expressed as a percent of household income; the x-axis is household income expressed as a percent of the federal poverty level (FPL). Subsidies are less generous as incomes increase, thus predictably the marginal cost of purchasing coverage increases as a percentage of income as incomes rise. However, because 1) households’ premium liabilities grow at the rate of health cost inflation; 2) health costs are very likel to inflate faster than wages; and, 3) the penalty for not purchasing coverage grows only at the rate of general (cost of living) inflation, the marginal cost of purchasing coverage (expressed as a percentage of income) should roughly double in the first ten years following the point at which (2016) households become subject to full penalties. And, this is households’ best case scenario, i.e. these figures assume households are purchasing only the minimum essential coverage (i.e. ‘bronze’) required to avoid the penalty. Exhibit 2 shows the declining relevance over time of penalties to the marginal costs of purchasing coverage; penalties are expressed as a percentage of households’ share of premiums (net of subsidies) on the y-axis, and incomes are again expressed as a percentage of FPL on the x-axis

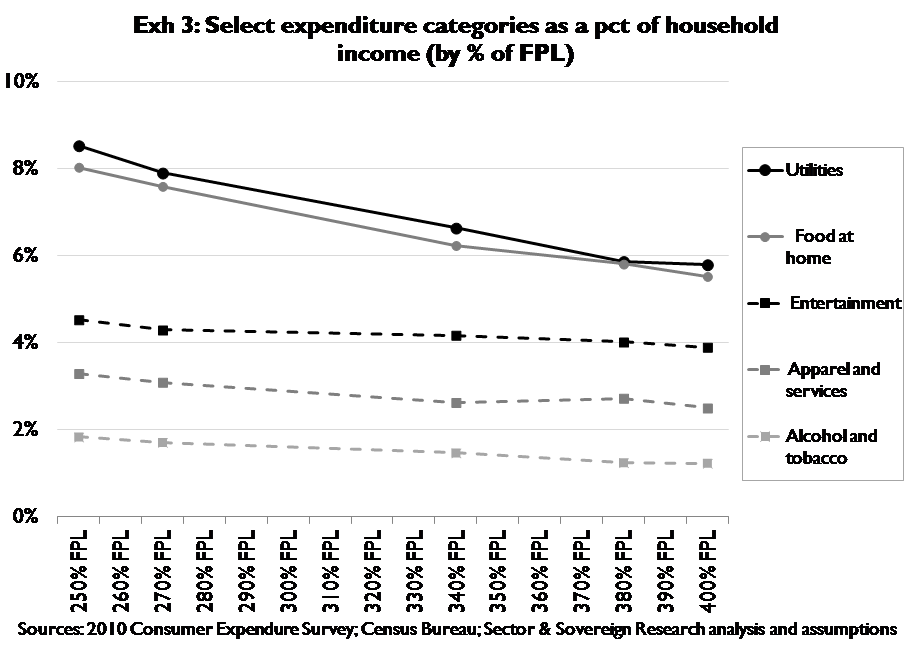

Exhibit 3 provides context on what else households purchase for a given percent of income; in 2016 the marginal cost of purchasing minimum essential health insurance (roughly 2

Exhibit 3 provides context on what else households purchase for a given percent of income; in 2016 the marginal cost of purchasing minimum essential health insurance (roughly 2

to 6 percent of income) looks similar to categories such as alcohol and tobacco, apparel and services, or even entertainment. However within a decade, the marginal cost of purchasing even minimum essential coverage (roughly 5 to 10 percent of income) is comparable to households’ current spending on essentials such as utilities and groceries

The preceding establishes that: 1) even though the penalty reduces the marginal cost of purchasing health coverage, the marginal cost remains quite high for a large proportion of households; and, 2) the relevance of the penalty to households’ marginal health insurance costs declines rapidly over time. Presumably, Congress enacted the penalty in order to assure the functionality of commercial health insurance markets, i.e. the penalty is intended as a counterweight to adverse selection. Critically, we find that the penalty is simply too small to serve this role on its own; and, that even the combination of subsidies and penalties are inadequate to prevent adverse selection across a large percentage of subsidy-eligible households. We believe many households will choose to remain uninsured – even if the mandate and penalty remain unchanged – and that adverse selection pressures will build to unsustainable  levels in a reasonably brief period. Thus to our minds, whether the mandate and penalty remain in place is irrelevant to the question of whether adverse selection creates unsustainable pressures; the mandate and penalty can only affect the rate at which these pressures unfold. From a slightly different angle, the mandate is not essential to the functionality of commercial health insurance markets under ACA – it is simply one (relatively small) part of an underpowered attempt to prevent adverse selection

levels in a reasonably brief period. Thus to our minds, whether the mandate and penalty remain in place is irrelevant to the question of whether adverse selection creates unsustainable pressures; the mandate and penalty can only affect the rate at which these pressures unfold. From a slightly different angle, the mandate is not essential to the functionality of commercial health insurance markets under ACA – it is simply one (relatively small) part of an underpowered attempt to prevent adverse selection

Handicapping the outcome

Timing: We believe the Supreme Court will hear arguments addressing the constitutionality of ACA before any penalties are levied (i.e. we believe the Anti-Injunction Act will not apply); accordingly we see a high likelihood of the Supreme Court ruling on or around June 2012

Constitutionality of the individual mandate: We cannot determine whether the individual mandate is more or less likely to be found constitutional. We do expect all nine justices to vote, and we do recognize that on balance the ideologies and records of the justices tend to point toward the mandate being overturned. However this tendency is not so compelling as to override the Court’s history of considering cases on their merits, and in a case of such complexity where credible precedents lie on either side of the constitutionality question, we have no credible way to handicap the ruling

Opponents of the mandate have called for Justice Kagan’s recusal on the argument that her service as Solicitor General throughout the time Congress was crafting (and passing) the ACA is a conflict of interest. Conversely supporters of the mandate have called for Justice Thomas’ recusal on the argument that his wife’s role as a lobbyist opposing the ACA also is a conflict. Neither justice has indicated they might recuse themselves from an ACA case, and given the “Mexican standoff” dynamic of two ideological opposites being pressured to recuse themselves, one recusal appears unlikely without the other. A single recusal also seems less likely in that this sets the table for a potential deadlock that, given the divergence of lower court opinion, might put ACA into a virtual purgatory. In the apparently unlikely event both Justices recuse themselves, the 7-vote handicapping looks very much like the 9-vote handicapping

Using only ideological background and prior rulings to estimate votes, one might reasonably anticipate 4 votes against the mandate from the conservative wing (Scalia, Thomas, Alito, Roberts); and 4 votes to uphold the mandate from the liberal wing (Ginsburg, Breyer, Kagan, Sotomayor), leaving Justice Kennedy as the swing vote. Judge Graham (Reagan nominee) of the 6th Circuit appears to have anticipated this situation when, in his dissent in Thomas More (quoted in the claimants petition for writ) he said,

“I believe the Court remains committed to the path laid down Chief Justice Rehnquist and Justices O’Conner, Scalia, Kennedy and Thomas (emphasis added) to establish a framework of meaningful limitations on congressional power under the Commerce Clause. The current case is an opportunity to do so.”

On balance we would tend to anticipate a vote against the mandate by Justice Kennedy, which implies a 5-4 decision against. Again however, the case at hand is simply too complex and the related precedent too strong on both sides of the constitutionality question(s) to handicap the outcome purely on the ideological backgrounds of the Justices, especially when the Court carries such a narrow ideological balance

Severability: Lower court decisions have called for no, partial, or complete severability. We believe the odds of no severability – i.e. of ACA being struck down if the mandate is not constitutional – are extremely low. The mandate has no discernable legal or economic relevance to many major provisions (e.g. Medicaid expansion) of the ACA, so we struggle to see how the Court would strike down the entire Act if it follows its own rules / precedent on severability to any extent whatsoever. At the opposite extreme we view the odds of no severability, i.e. of no other provisions being struck down if the mandate is unconstitutional, as being only slightly lower than the odds of the Court finding partial severability. We believe Congress intended the mandate to serve as a defense against adverse selection, and that this intended defense was put in place to help guard against the known tendency of commercial insurance provisions (e.g. guaranteed issue) to raise the risk of adverse selection. Accordingly, if the mandate is vacated, it’s a reasonable likelihood that the Court would also choose to eliminate the commercial insurance market reforms that tend to rely (at least in part) on the mandate as a counterweight to adverse selection. Despite our conviction that the economic relevance of the mandate is considerably overestimated, we recognize that we hold the minority view. This leaves partial severability – specifically the narrow elimination of commercial insurance market provisions that raise the risk of adverse selection – as the (marginally) most likely outcome

Appendix I: Prior litigation history

1. Thomas More Law Center et al v. Obama et al

|

District court ruling (Eastern Michigan) |

Minimum coverage provision upheld |

|

6th Circuit court ruling |

District court AFFIRMED |

|

6th Circuit Court Judges (Appointment) |

Martin (CARTER)Sutton (GW BUSH)Graham (REAGAN) |

|

Anti-Injunction Act applicability |

Does not apply because shared responsibility payments are a penalty not a tax (3-0) |

|

Mandate – Commerce Clause |

Valid exercise of Congressional power under Commerce Clause (2-1 [Graham]) |

|

Mandate – Taxing and Spending Clause |

Not necessary for affirmation, but since the penalty is not a tax, “Congress’ taxing power thus cannot sustain it” (3-0) |

|

Severability |

n/a |

|

Petition for writ of certiorari filed? |

Yes, 7/28/11 |

| Questions presented | (1) Does Congress have the authority under Commerce to require private citizens to purchase and maintain “minimum essential” healthcare insurance coverage under penalty of federal law? (2) Is the individual mandate provision of the Act unconstitutional as applied to Petitioners who are without healthcare insurance? |

2. State of Florida et al v. US Department of Health and Human Services et al (note: this is the case that 26 states joined as plaintiffs)

|

District court ruling (Northern Florida) |

Minimum coverage unconstitutional and non-severable, which invalidates the entire ACA |

|

11th Circuit court ruling |

District Court AFFIRMED on merits; REVERSED on severability and only invalidated the mandate itself |

|

11th Circuit Court Judges (Appointment) |

Dubina (GHW BUSH) Hull (CLINTON) Marcus (CLINTON) |

|

Anti-Injunction Act applicability |

No explicit ruling, but by reaching a decision on merits court implicitly rules AIA does not apply (3-0) |

|

Mandate – Commerce Clause |

Mandate exceeds Congress’ authority since it “embodies no judicially enforceable limits of its exercise” (2-1 [Marcus]) |

|

Mandate – Taxing and Spending Clause |

Operates at as a regulatory penalty not a tax and cannot be sustained under Taxing and Spending Clause (3-0) |

|

Severability |

Mandate is severable based on a presumption of a severability rooted in judicial restraint, overruling district court |

|

Petition for writ of certiorari filed? |

Yes, 9/26/11 |

| Questions presented |

(1) Whether Congress had the power under Article I of the Constitution to enact the minimum coverage provision; and (2) Whether the suit brought by respondents to challenge the minimum coverage provision is barred by the Anti-Injunction Act. [note: Both respondents agree that it does not, but request settlement given 4th circuit decision in Liberty (see below)] |

3. Liberty University et al v. Geithner et al

|

District court ruling (Western Virginia) |

Minimum coverage provision upheld |

|

4th Circuit court ruling |

VACATED for lack of jurisdiction under the Anti-Injuncton Act |

|

4th Circuit Court Judges (Appointment) |

Motz (CLINTON) Wynn (OBAMA) Davis (OBAMA) |

|

Anti-Injunction Act applicability |

AIA bars consideration of the challenge which constitutes a pre-enforcement action seeking to restrain assessment of a tax (2-1 [Davis]) |

|

Mandate – Commerce Clause |

Davis dissented on AIA, but would have upheld the mandate under Commerce – “though centralized subsidies are far more efficient than mandates they are, in effect, the same” |

|

Mandate – Taxing and Spending Clause |

Wynn concurred on AIA, but on merits would have upheld mandate under Taxing and Spending Clause |

|

Severability |

n/a |

|

Petition for writ of certiorari filed? |

Yes, 10/7/11 |

| Questions presented |

(1) Whether the AIA bars courts from deciding [merits of mandate]; (2) Whether Congress exceeded its enumerated powers by forcing individuals to purchase health insurance, and if so to what extent can this part of the scheme be severed; and (3) Whether Congress exceeded its enumerated powers by forcing private employers into the health insurance market, and if so to what extent can this essential part of the scheme be severed? |

4. Commonwealth of Virginia v. Sebelius

|

District court ruling (Eastern Virginia) |

Minimum coverage unconstitutional and non-severable, which invalidates the entire ACA |

|

4th Circuit court ruling |

VACATED for Virgina’s lack of standing since mandate imposes no obligation on the state, and states cannot sue as parens patriae for their citizens (3-0) |

|

4th Circuit Court Judges (Appointment) |

Motz (CLINTON) Wynn (OBAMA) Davis (OBAMA) |

|

Anti-Injunction Act applicability |

n/a |

|

Mandate – Commerce Clause |

n/a |

|

Mandate – Taxing and Spending Clause |

n/a |

|

Severability |

n/a |

|

Petition for writ of certiorari filed? |

Yes, 9/30/2011 (Also filed petition for writ on 2/8/11 before the 4th Circuit ruled, but not surprisingly this was denied, 4/25/11) |

| Questions presented |

(1) Whether states have standing; (2) Whether VA law is merely symbolic and incapable of giving rise to a sovereign injury; (3) Whether states are prevented from challenging a U.S. enactment on enumerated powers grounds; and (4) Whether a private purchase mandate exceeds the limits of the Commerce Clause, even as executed by the Necessary and Proper Clause |

5. Seven-Sky et al v. Holder et al (formerly Mead et al v. Holder)

|

District court ruling (DC) |

Mandate is constitutional and doesn’t violate the Religious Freedom Restoration Act |

|

DC Circuit court ruling |

Pending |

|

DC Circuit Court Judges (Appointment) |

Edwards (CARTER) Silberman (REAGAN) Kavanaugh (GW BUSH) |

|

Anti-Injunction Act applicability |

– |

|

Mandate – Commerce Clause |

Observers of oral arguments predict that the mandate could be invalidated based on questioning. Silberman / Kavanaugh pressed government attorneys for a single example of an economic mandate that would be unconstitutional under their interpretation, and they could not come up with one (see “D.C. Appeals Court Points the Way to the Defeat of Obamacare’s Individual Mandate” on Forbes.com) |

|

Mandate – Taxing and Spending Clause |

– |

|

Severability |

– |

|

Petition for writ of certiorari filed? |

– |

| Questions presented |

– |

Appendix II: Resources

For primary sources and documents related to ACA litigation (including opinions, briefings, petitions, dockets, etc.) see:

U.S. Department of Justice:http://www.justice.gov/healthcare/

American Constitutional Law Society:http://www.acslaw.org/

Supreme Court of the United States:http://www.supremecourt.gov

United States Federal Courts:http://www.uscourts.gov/FederalCourts

ACA Litigation Blog:http://acalitigationblog.blogspot.com/

[1] Government lawyers had argued (unsuccessfully) in district court that the AIA did preclude judicial intervention in Liberty, however the mandate was upheld nonetheless. In appeals, their position changed and they asked with their opponent that the case be decided on merits

[2] Quotation from INS v Cardoza-Fonesca

[3] Plaintiff Mead has since dropped out of the lawsuit, and in the DC Circuit Court the same case is known as Seven-Sky v Holder

[4] Wickard v Filburn (1942)

[5] Gonzalez v Raich (2005)

[6] U.S. v Lopez (1995)

[7] U.S. v Morrison (2000)

[8] By no means do we favor being uninsured – our only motive here is to establish that each individual’s consumption of healthcare does not necessarily impose costs on others

[9] Other than the obvious examples of healthcare markets that straddle state lines – e.g. Kansas City

[10] All other cases we have considered in this call have been argued at the Circuit Court level. Goudy-Bachman was only decided in district court on September 13, 2011 and has yet to be appealed to – let alone heard by – the 3rd Circuit Court of Appeals