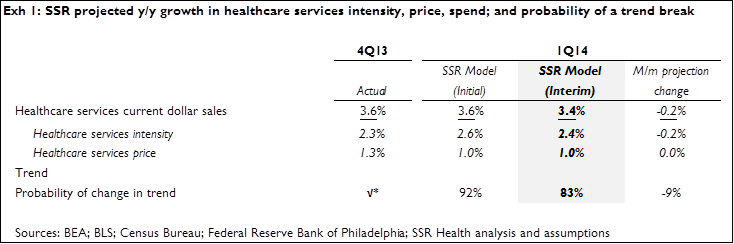

We expect 1Q14 health services demand growth (y/y, nominal) of 3.4%, the product of 2.4% growth in intensity demand and 1.0% growth in nominal pricing (Exhibit 1). Our estimate of y/y growth in intensity is 10bp above 4Q13 actual, but a 20bp drop from our initial 1Q14 estimate. Our nominal pricing forecast is a full 30bp below last quarter (unchanged from the initial 1Q14 estimate) – and 10bp below the multi-year low observed during 3Q13. Separate from our growth rate forecast, we run an independent model which handicaps the odds of a trend break in demand. This model suggests better than even odds (82%) of accelerating (4Q13 v. 3Q13) demand during 1Q14

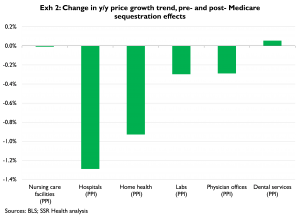

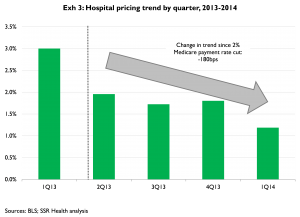

Pricing has been extremely weak since the 2% across the board cut in Medicare provider payments began last April (and which were extended through 2023 in the bipartisan budget compromise passed in December) (Exhibit 2). The trend has not really moderated since the shock – particularly for Hospitals where pricing growth through February was weaker than in any quarter since 1998 (Exhibit 3). In the context of a slew of reform-related changes that should negatively affect net hospital pricing[1], we anticipate continued weakness in the near- to mid-term

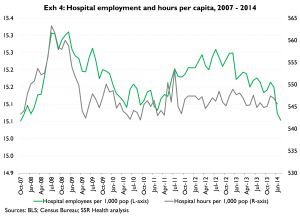

The biggest factor in the sequential deceleration in our 1Q14 intensity growth forecast is a sudden (February 2014) decline in hospital employment. Hospital employment per-capita, and per-capita hours worked by hospital employees generally move together (Exhibit 4); we believe this reflects hospital administrators’ efforts to closely adjust payrolls to demand. Following a brief but significant demand surge in mid-2011 administrators appear to have kept more labor on hand than was necessary (employees per capita remained elevated (green line) even though hours worked per-capita fell (grey line)). The normal reflex of reducing payrolls as the demand surge diminished may have been tempered by an expectation of rising demand driven by the 2014 ACA roll-out; as these expectations have weakened, we speculate that administrators have responded by reducing employment – particularly as we approach the end of the initial enrollment period. If we’re correct, this means the employment decline reflects reduced forward expectations rather than a sequential slowing of demand, in which case our original 2.6% estimate for 1Q14 may prove to be more accurate than the revised estimate of 2.4%

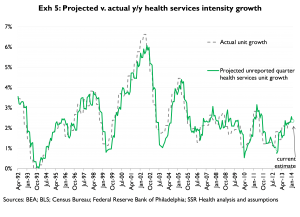

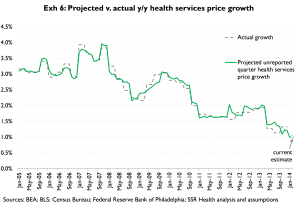

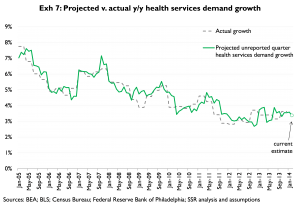

Exhibits 5, 6, and 7 provide time series of actual v. projected unit demand, price growth, and total demand, respectively

2013-2014 Flu Season

As the end of calendar 1Q14 approaches next week, we have taken a closer look at our estimates of flu-related demand since last October. Incorporating both Google flu estimates of ILI[2] and CDC FluView data on laboratory-confirmed influenza hospitalizations, we would reiterate our estimate that the flu-related headwind for total y/y health services demand growth during 4Q13-1Q14 is roughly +/-30bp. Based on hospitalizations, we would refine that estimate to +/-20bp during 4Q13 and +/-40bp during 1Q14. The net hospitalization rate for this flu season has leveled off about 27% below last year’s

[1] Including expansion of low-reimbursement Medicaid, narrower exchange plan networks, and higher commercial deductibles, higher out-of-pocket costs which yield lower collection rates. For more detail, see “Hedge Hospital Pricing Risks with Non-Rx Consumables,” SSR Health, 3/11/2013

[2] Influenza-like illness