This note compares the two drug acquisition cost benchmarks (Average Manufacturer Price or AMP, and National Average Drug Acquisition Cost or NADAC) that CMS intends to make public. NADAC values have not been calculated or published; however because Alabama’s Average Acquisition Cost (AAC) index is for practical purposes functionally identical to NADAC, we use known AAC values as a ‘stand-in’ for NADAC in this comparison

AMP is the price paid to a manufacturer by a wholesaler or warehousing chain for drugs dispensed at retail pharmacy, MINUS incentives such as discounts and rebates that the manufacturer passes along to the retailer, other than ‘normal’ manufacturer-to-retail or manufacture-to-wholesale payments for stocking, returned or damaged goods and so forth. AAC/NADAC on the other hand is the average invoice price paid by a retailer to a wholesaler. Even though chargebacks are not broken out on invoices, AAC/NADAC does reflect the effect of chargebacks, since the invoice prices seen by retailers are net of chargebacks. On balance, we believe the essential differences between AAC/NADAC and AMP are that only AAC/NADAC captures wholesalers’ gross margins, and that only AMP captures the value of off-invoice (i.e. non-chargeback) incentives (other than bona fide service fees) paid by manufacturers to either wholesalers or retailers. More simply: AMP + off invoice incentives + wholesaler gross margin ≈ AAC/NADAC

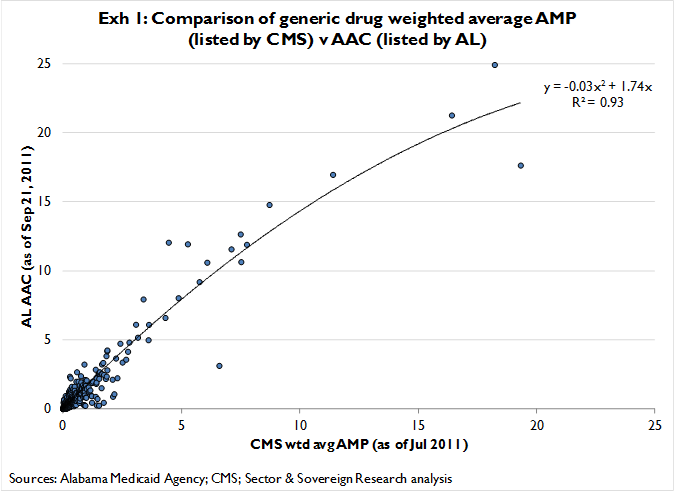

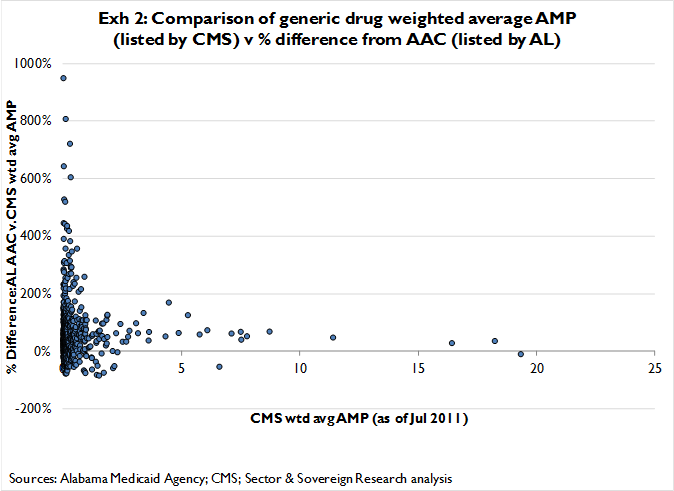

We have AAC prices for 1,886 drug / dose / formulation combinations under the Alabama program; and, from CMS’ recent posting of Federal Upper Limit (FUL) and AMP data, AMP prices for 719 of these combinations. We compared AAC and AMP values for all drug / dose / formulation combinations (661) having both an AAC and AMP value

On a (simple weighted) average basis, AMP is 20.33% lower than AAC. However the gap between AAC and AMP tends to be higher at very low AMP values, and lower at very high AMP values (Exhibit 1,2). We speculate that this is because AAC incorporates wholesaler gross margin, but AMP does not. Presumably, wholesalers need a minimum amount of gross profit per stock keeping unit (SKU) in order to make carrying that SKU worthwhile. For SKUs with very low values, wholesalers’ minimum gross profit amount would tend to be fairly large relative to the value of the SKU. Thus very low value SKU’s should have higher AAC’s (which include wholesaler gross margin) than AMPs (which does not), and this is generally the pattern we find

Assuming the inclusion of wholesaler margins in AAC but not AMP in fact explains this pattern, then we believe that all else held equal, AAC/NADAC is better than AMP for the broad purpose of estimating retailers’ ‘true’ acquisition costs across their entire inventory. Independent retailers have to pay wholesalers for inventory, including of course the wholesalers’ gross margin. Thus AAC, by including wholesale margin, more accurately reflects (particularly independent) retailers’ ‘true’ acquisition costs, especially in the case of very low dollar value SKUs. As SKU values rise, wholesale margins fall as a percentage of true acquisition cost, and we believe this is why AAC and AMP values become more similar at higher product values

However the heart of the pricing index matter is whether an AWP replacement will pressure generic dispensing margins. To understand the relative effects of AAC/NADAC and AMP on generic margins we need to focus somewhat narrowly on higher value generic products. This is because the drug trades’ total generic margin is found in a relatively small number of products, and these products tend to be younger with higher (but rapidly falling) prices. In the current market, AAC/NADAC and AMP values are similar with higher priced products, and as we’ve argued this appears to be due to lower percentage wholesale margins at higher price levels. However bear in mind that where AMP includes off-invoice manufacturer-to-retailer incentive payments, AAC/NADAC does not. Thus in a market benchmarked to an AAC/NADAC pricing index, manufacturers could provide retail incentive payments without lowering AAC/NADAC values – and thus re-imbursement levels – and presumably would do so. This would force AAC/NADAC values to be higher than AMP values for higher value products, as is already the case for lower value products. More importantly, AAC/NADAC could rapidly become a less accurate (than AMP) reflection of pharmacies ‘true’ acquisition costs at the higher value end of the generic market, which would tend to mitigate – but presumably would not eliminate — the effect of AAC/NADAC on generic dispensing margins

We conclude that AMP is an at least somewhat more robust threat to the trades’ generic dispensing margins than AAC/NADAC, though we continue to believe that even a ‘gamed’ AAC/NADAC is far more predictive of ‘true’ acquisition costs than the current AWP standard. Accordingly we believe the trades’ generic dispensing margins are likely to fall irrespective of which index becomes the new standard, though it is reasonable to assume generic dispensing margins fall further / faster if AMP is the that new standard

The investment relevance here is two-layered. First and most important, CMS has two chances to produce an alternative to AWP, and either alternative appears sufficiently related to true acquisition costs to result in lower generic dispensing margins. Having two equally suitable indices with largely independent odds of surviving legal challenges simply raises the odds that one of the indices will survive the various challenges involved in replacing AWP. Second, assuming AWP is replaced, the trades’ might fare at least somewhat better (i.e. defend at least some portion of generic dispensing margins) if AAC/NADAC (which is relatively easily gamed) becomes the new standard. This presumes that CMS makes no adjustment to AAC/NADAC to account for off-invoice incentives (e.g. a simple comparison to AMP values, or a supplemental survey). It is not yet clear which index is more likely to become the new standard, nor is it yet clear whether CMS sees and intends to address the potential deficiency in AAC/NADAC