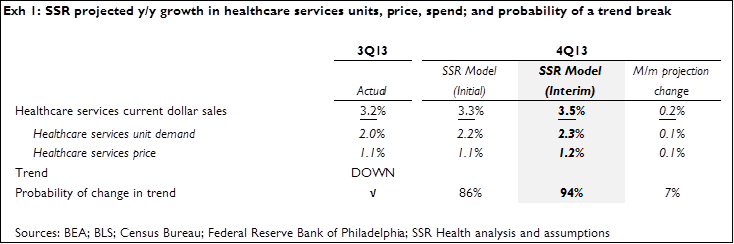

We expect 4Q13 health services demand growth (y/y, nominal) of 3.5%, the product of 2.3% growth in unit demand and 1.2% growth in nominal pricing (Exhibit 1). Our nominal pricing forecast is up just 10bp from last quarter’s multi-year low, while our estimate of y/y growth in unit demand is 30bps above 3Q13 (and 10bp higher than our initial 4Q13 estimate). Separate from our growth rate forecast, we run an independent model which handicaps the odds of a trend break in demand. This model suggests a strong likelihood (93%) of accelerating (4Q13 v. 3Q13) demand

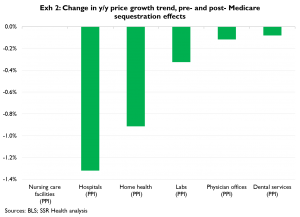

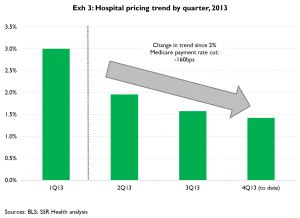

The pricing trend has been extremely weak since the 2% across the board cut in Medicare provider payments began on April 1 (Exhibit 2). And, most notably, the trend has not really moderated since the April shock (Exhibit 3). We did see a modest sequential rise in the Hospital pricing trend in November (1.2% to 1.6%), but it is too early, the increase too slight, and the absolute number still too low to predict with any confidence that pricing is positioned to revert to prior levels. The improvement in unit demand forecasts is a function of rising momentum in both wages and hours for health workers, which offset another dip in overall GDP growth forecasts in the Philadelphia Fed Survey of Professional Forecasters

Our estimates of demand dynamics for health services rely on several measures of underlying economic activity; included among these variables are measures of general economic activity and health-system specific activity, as well as forward expectations about US economic conditions

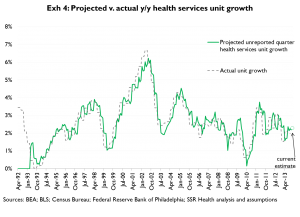

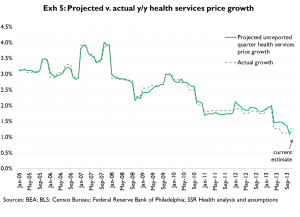

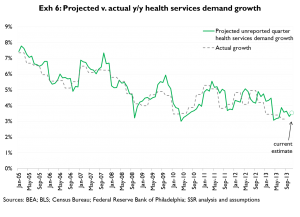

Exhibits 4, 5, and 6 provide time series of actual v. projected unit demand, price growth, and total demand, respectively

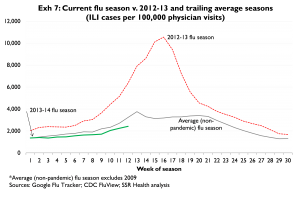

2013-2014 Flu Season

After the first 12 weeks of the 2013-14 flu season, this season now looks milder than the average (non-pandemic), season (Exhibit 7). Over the past decade, the majority of the variance in total-season severity can be explained by the severity at this point in the season – i.e., it’s not too early to say that the flu season now looks more likely to be closer to an average year than to last year. An average 2013-14 flu season would translate into a +/- 30 bps headwind for total y/y health services demand growth during 4Q13