7.5 million persons selecting a plan …

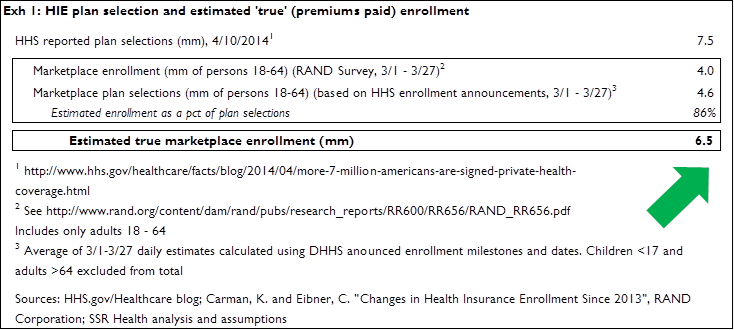

On Thursday the Administration announced a revised enrollment estimate of 7.5 million persons for the Affordable Care Act’s (ACA) health insurance exchanges (HIEs). This figure is based on the number of persons who have selected a plan; the more meaningful enrollment figure will be this 7.5 million ‘plan selection’ total times the percent of persons who follow-thru and pay their premiums

… translates into 6.5 million persons who have paid (or are likely to pay) premiums …

This percentage is roughly 85%, which we triangulate to from various points. The former HHS[1] Secretary has publicly stated that the percent of persons selecting a plan who pay premiums is between 80 and 90 percent. McKinsey’s February 2014 survey found that 77 percent of respondents who had selected plans had paid premiums (86 percent of the previously insured paid premiums, as compared to 53 percent of the previously un-insured). Conservatively, we treat the McKinsey 77 percent figure as a low estimate since respondents still arguably had time to pay; and because March ‘plan selectors’ presumably are more likely to pay than earlier ‘plan selectors’. Finally by comparing RAND figures for persons enrolled (presumably, selected AND paid) in an HIE plan to HHS figures for persons have selected a plan, on a timeframe (3/1-3/27) and age group (18-64) matched basis, we estimate that 4.0 million persons enrolled fully out of the 4.6 million persons who selected a plan, a ratio of 86 percent (Exhibit 1). Thus of the 7.5 million persons selecting plans on the HIEs, it appears that roughly 6.5 million persons are ‘true’ enrollees in the sense of having paid, or being likely to pay, their premiums

… 4.2 million of whom were already insured in 2013

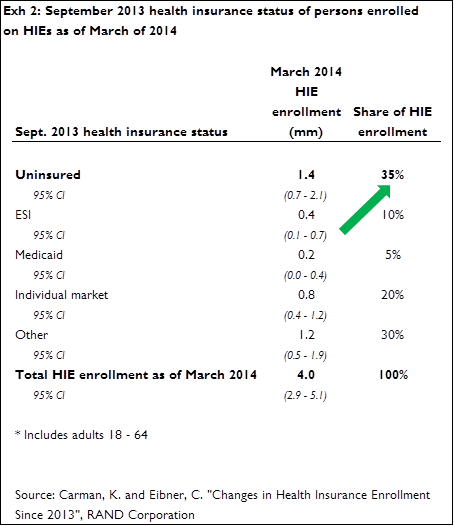

The next question becomes one of ‘net’ gains in total numbers of insured. A recent RAND study[2] evaluated the September 2013 health insurance status of persons who had enrolled in health insurance on the HIEs as of March 2014. Of the 4 million total March 2014 enrollees[3] RAND found that 1.4 million, or 35 percent, were uninsured in September of 2013 (Exhibit 2). The RAND figure resonates with other estimates: McKinsey’s February study found that only 27 percent of HIE enrollees as of that point had been previously uninsured; Express Scripts reported[4] that 43 percent of HIE enrollees in plans for which they administer prescription benefits were Express Scripts beneficiaries in 2013. The remaining 57 percent would by definition have to be either previously uninsured, or 2013 beneficiaries of another insurer or PBM. Applying the RAND figure of 35 percent to the 6.5 million estimate of ‘true’ enrollees indicates that roughly 2.3 million previously un-insured persons have gained health insurance on the HIEs

HIE enrollees are both older, and apparently sicker, than the population on average

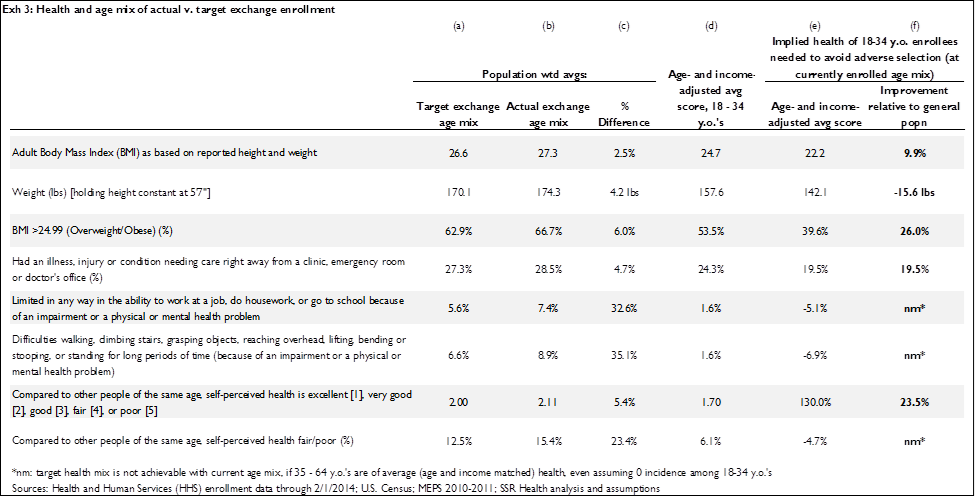

The final HIE-related question is whether the health mix of enrollees is or is not likely to result in adverse selection. HHS figures for HIE enrollment through March 1 reflect an age mix wherein 26 percent of enrollees are aged 18 – 34; we and others have argued that, assuming enrollees are a random-grab of health risks by age group, roughly 40 percent of enrollees will need to be in the 18 – 34 age group to avoid adverse selection. Evidence from the Gallup Healthways survey, which includes responses thru March 31, indicates the proportion of younger enrollees has remained constant as the open enrollment end date approached

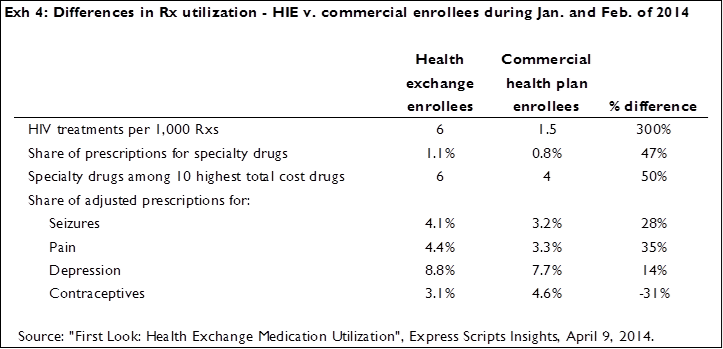

The argument has been made that having fewer young enrollees would be viable if enrollees’ are generally healthy, which at the risk of being harsh is both obvious and absurd. As we showed in an earlier research note[5], for the most recently reported age-mix of enrollees not to result in adverse selection, among other health indicators those enrolling would have to be on average more than 15 pounds lighter than persons of the same age in the general population – wildly unlikely (Exhibit 3). If anything, HIE enrollees are likely to be less healthy than persons of the same age (and income) in the general population, and evidence from the recent Express Script report bears this out. HIE enrollees are substantially more likely than other commercial health insurance beneficiaries to be users of prescriptions generally associated with significant illness (Exhibit 4)

Medicaid enrollment is up 5.7 million, 3.6 million of whom were previously uninsured; 9 million ‘R-state’ beneficiaries in the wings

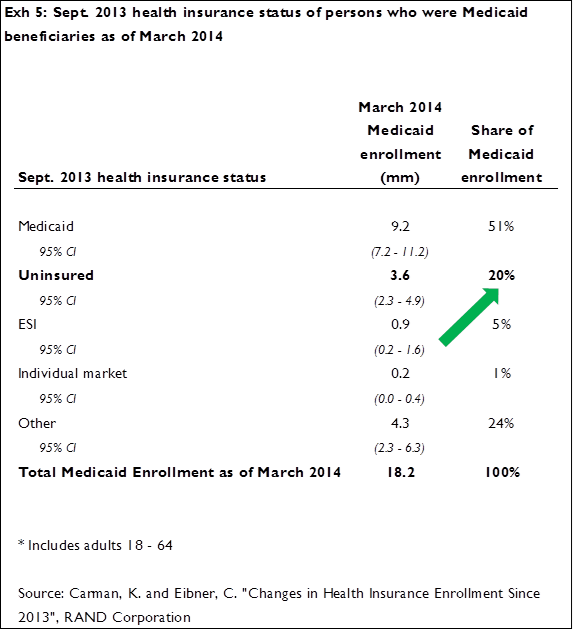

Switching gears to Medicaid, and again working from the RAND survey, enrollment as of September 2013 was 12.5 million; in March of 2014 enrollment had grown by 5.7 million to a total of 18.2 million. Exhibit 5 provides the breakout of March 2014 enrollees according to their 2013 insurance status; of the 5.7 million new Medicaid beneficiaries in 2014, 3.6 million were uninsured last September

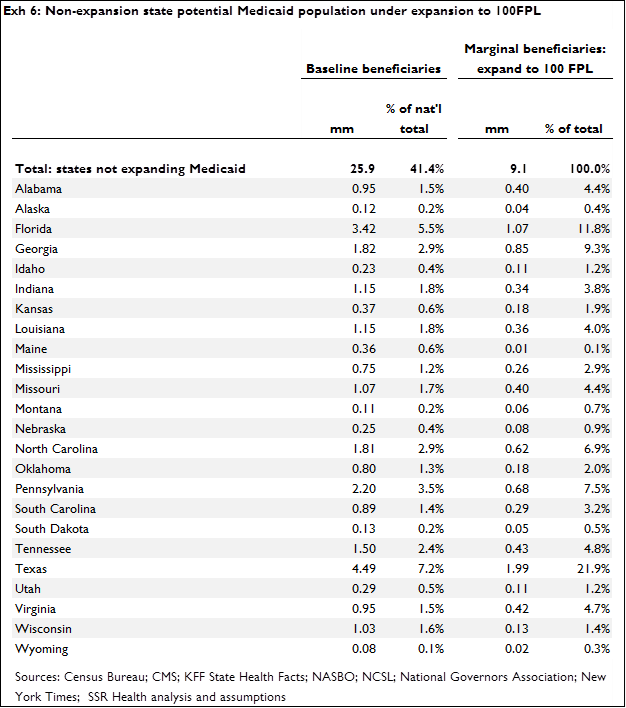

We continue to believe that states who have not yet participated in the expansion ultimately will expand their Medicaid programs’ upper eligibility limits to 100 percent of the federal poverty level (FPL). Recall that former HHS Secretary Sebelius instituted a policy withholding enhanced federal matching funds from states that did not expand Medicaid fully to 138 FPL. This policy is set to expire at the end of 2016, at which point we would expect the non-participating states to expand to 100 FPL. Notably, with Secretary Sebelius having been replaced, there is some possibility of the new secretary rescinding or modifying the Sebelius policy, thus allowing the enhanced match for states expanding to 100FPL to become available before the end of 2016. Regardless of the specific timing, we do expect these states to expand to 100 FPL, which implies further Medicaid enrollment gains of roughly 9 million persons (Exhibit 6)

We continue to believe that states who have not yet participated in the expansion ultimately will expand their Medicaid programs’ upper eligibility limits to 100 percent of the federal poverty level (FPL). Recall that former HHS Secretary Sebelius instituted a policy withholding enhanced federal matching funds from states that did not expand Medicaid fully to 138 FPL. This policy is set to expire at the end of 2016, at which point we would expect the non-participating states to expand to 100 FPL. Notably, with Secretary Sebelius having been replaced, there is some possibility of the new secretary rescinding or modifying the Sebelius policy, thus allowing the enhanced match for states expanding to 100FPL to become available before the end of 2016. Regardless of the specific timing, we do expect these states to expand to 100 FPL, which implies further Medicaid enrollment gains of roughly 9 million persons (Exhibit 6)

For your reference: net shifts across all insurers

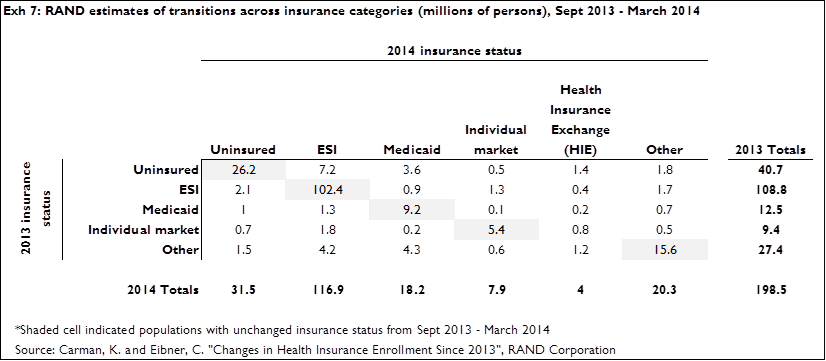

Exhibit 7 summarizes September 2013 (rows) and March 2014 (columns) insurance status across all payers, according to RAND. Using the HIE column as an example: as of March, RAND estimates 4 million HIE enrollees (lower than the HHS estimate because RAND only counts 18-64 year olds, where HHS counts all ages; and, RAND appears to only count persons having paid premiums where HHS counts all persons having selected a plan), 1.4 million of whom were uninsured in 2013, 0.4 million of whom were in ESI as of 2013, 0.2 million of whom were in Medicaid as of 2013, 0.8 million of whom were in the individual market as of 2013, and 1.2 million of whom were insured by an ‘other’ source (typically military, Medicare, other governmental plans, and retiree insurance) as of 2013

[1] ^ US Department of Health and Human Services

[2] ^ Carman, K. and Eibner, C. “Changes in Health Insurance Enrollment Since 2013”, RAND Corporation

[3] ^ The RAND figure is less than the HHS figure for two reasons: 1) RAND appears to only count those who have paid their premiums, where HHS counts all those selecting a plan; and 2) RAND figures are for persons aged 18-64 only, where HHS figures are for all ages

[4] ^ “First Look: Health Exchange Medication Utilization”, Express Scripts Insights, April 9, 2014.

[5] ^ “ACA Enrollment and Adverse Selection Pressures – An Update,” SSR Health, February 2, 2014