Summary and Conclusion

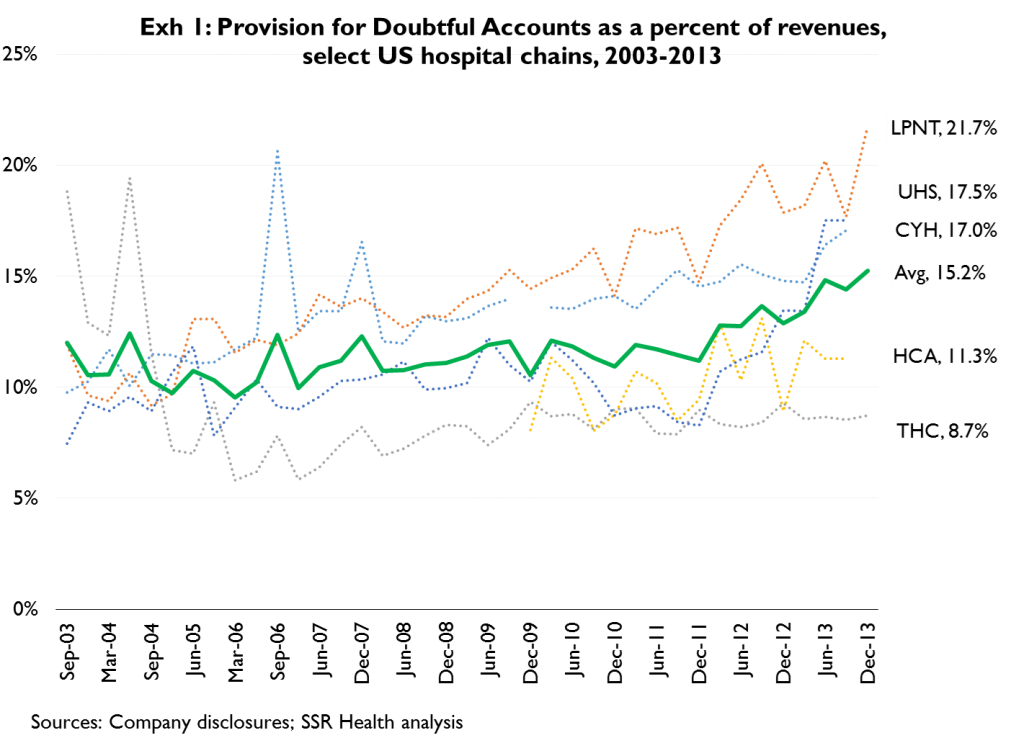

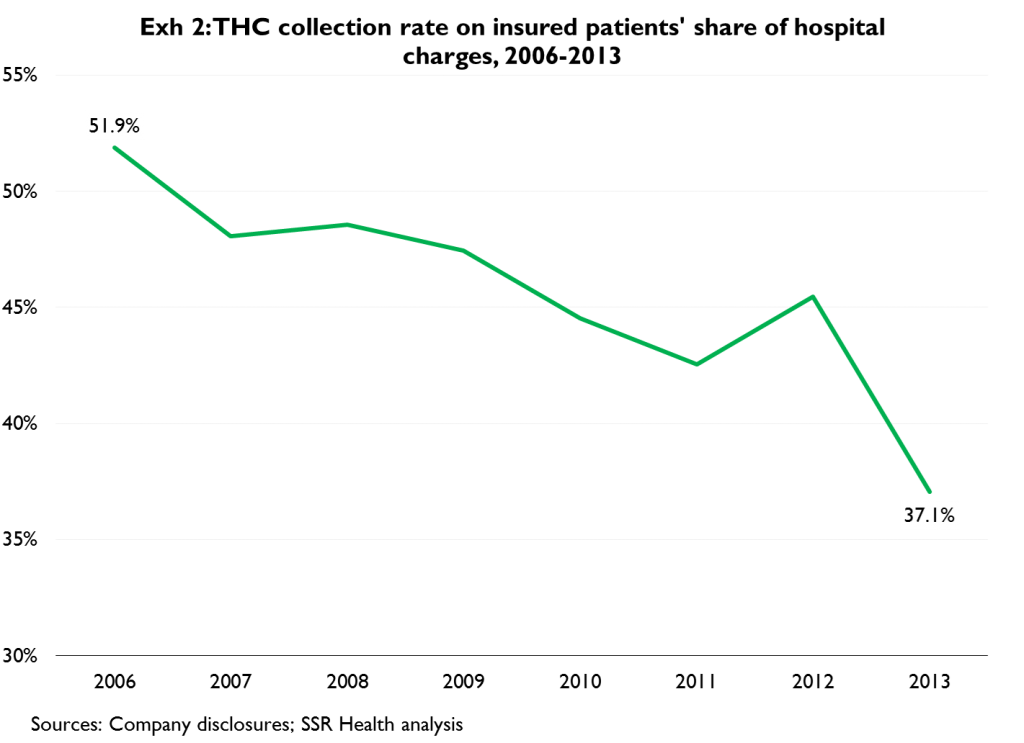

Hospitals’ provisions for doubtful accounts have been rising (Exhibit 1); we believe this is in large part due to falling collection rates on the self-pay portion of insured patients’ hospital charges (Exhibit 2). As commercial (particularly employer sponsored insurance, or ‘ESI’) forms of insurance have shifted more toward high deductible designs, patients have become responsible for larger percentages of hospitals’ billed charges; and, as the average amounts owed by patients have risen, they’ve become less and less likely to pay (Exhibit 2, again). We believe much of the employer sponsored insurance market will shift to a private health insurance exchange setting, where employees will on average choose even less generous coverage – producing further rises in the percent of hospital charges due from patients, and corresponding further declines in hospitals’ ability to collect these charges. That’s the bad news

The good news is that the number of uninsured persons is falling as states expand Medicaid and net commercial enrollment rises with the opening of the Affordable Care Act’s health insurance exchanges (HIEs). Unfortunately the Medicaid expansion has been smaller than originally expected, and HIE enrollment weaker – which begs the question of which effect is bigger. Specifically, will the falling generosity of employer sponsored insurance impair hospitals’ ability to collect charges faster than falling numbers of uninsured improve collections?

Over several years, we believe the best case scenario is for hospitals’ aggregate collection rates (across all sources of payment, including the uninsured) to stabilize, though the risks are plainly to the downside. For this reason, we believe that investing in hospitals’ suppliers (e.g. BD, CFN, COV, OMI, etc.) is a substantially better idea than investing in hospitals themselves

Demand Growth and Share Price Performance

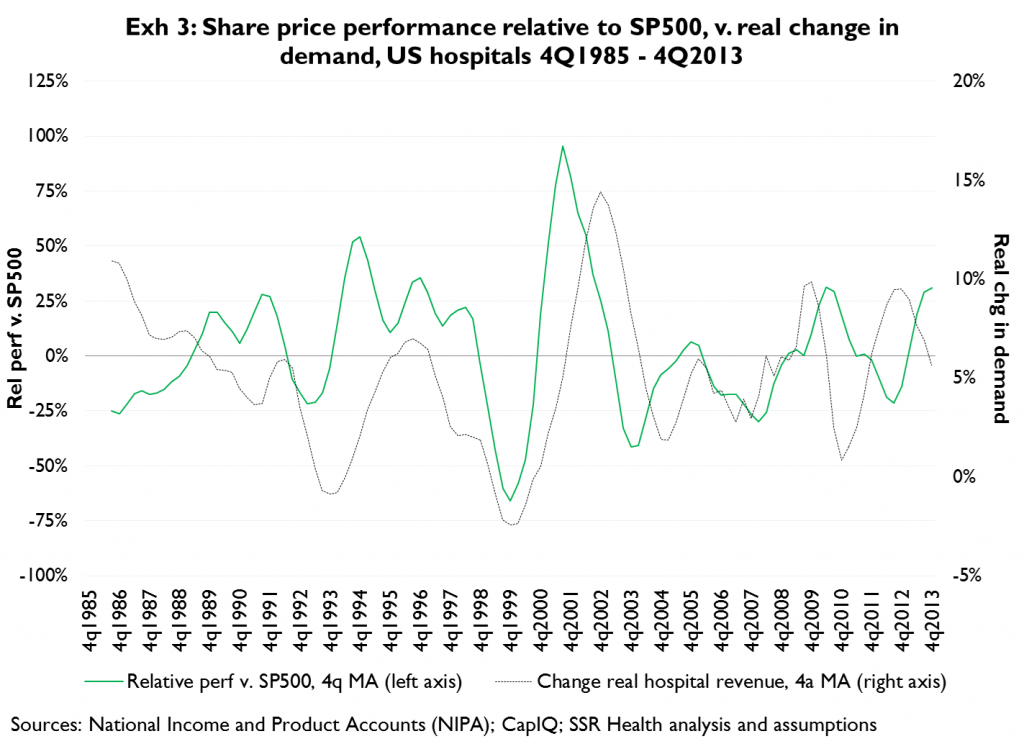

Shares of US hospitals tend to outperform on rising demand, and underperform on falling demand (Exhibit 3). Current demand is quite weak in terms of both units and pricing; simplistically this would argue that demand is more likely to rise than fall, and that hospitals are thus more likely to outperform than underperform

Current Unit Demand is Unsustainably Low, and Far More Likely to Rise than to Fall

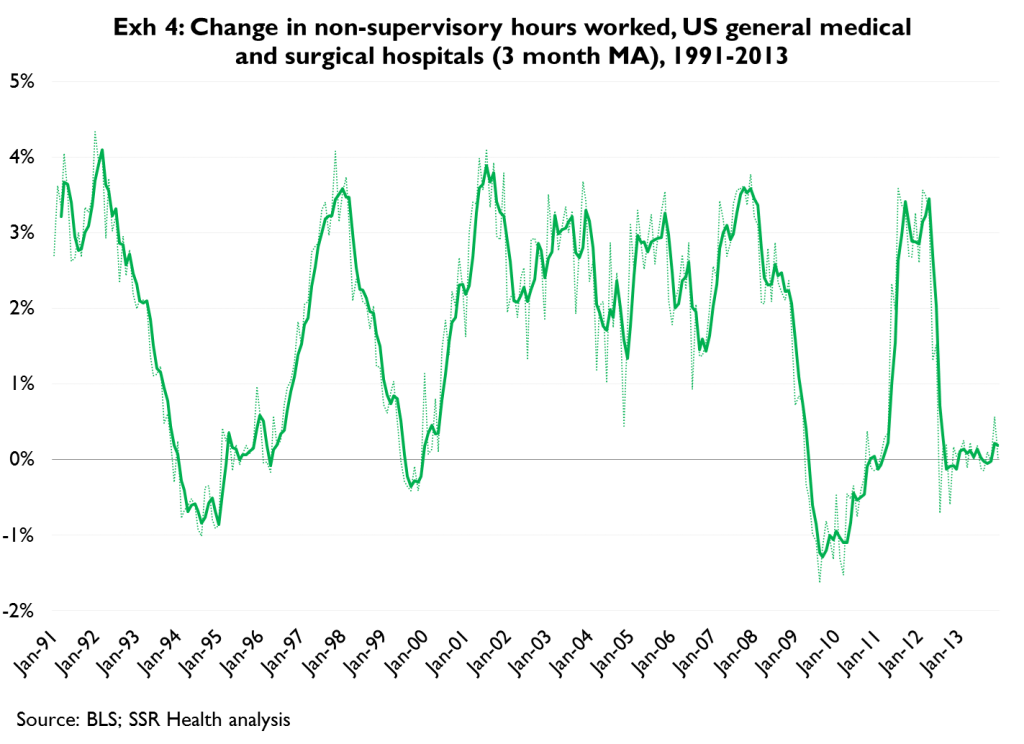

We use hospitals’ non-supervisory labor hours as a contemporary indicator of demand[1]; Exhibit 4 shows the change in hours worked since 1991, and in particular shows that current demand growth has returned to near-historic lows after a brief post-financial-crisis recovery. The 2014 Medicaid expansion has so far brought about 3M newly under coverage[2], and the health insurance exchanges should produce 2014 net coverage gains in the neighborhood[3] of 2M persons. On top of this, rising employment translates into a larger percentage of the population falling under employer-sponsored health insurance (which is substantially more generous than other forms), and this typically results in substantial unit demand growth. Taken together, the case for accelerating hospital unit demand is remarkably strong

Aggregate Pricing (gross of collections) is Stabilizing ….

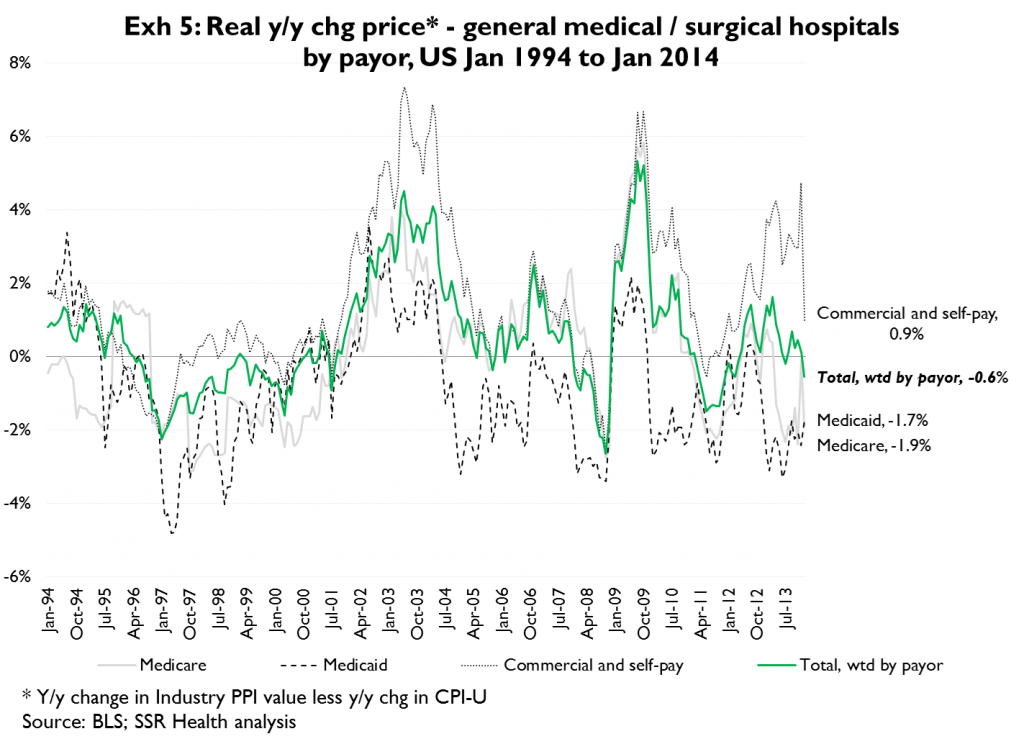

Hospitals’ current pricing is slightly (50bp) negative in real terms; falling Medicare and Medicaid reimbursement rates have been offset by reasonably strong pricing growth from commercial payors (Exhibit 5). Barring further policy actions the negative Medicare / Medicaid trend should moderate as these reductions are anniversaried; and, hospitals’ net pricing begins to benefit as the Medicaid expansion and health insurance exchange roll-out reduce the numbers of uninsured. If net (of collections risk) commercial pricing could be held steady we could make a case for modest real price growth which, coupled with an expectation of growing unit demand, would point to hospitals outperforming

… But Commercial Pricing Leverage is Weakening, and Commercial Collection Risks are Rising

Unfortunately hospitals’ commercial pricing leverage is diminishing, and collections risks relating to the self-pay portion of insured patients’ hospital charges is rising. In January of 2012[4] we made the case that higher profile hospitals would enjoy rising commercial pricing as insurers developed their health insurance exchange networks, and we believe this has played out (Exhibit 5, again). We also argued that hospitals’ ‘pre-exchange’ commercial pricing power would diminish after the initial enrollment period, which of course is now. And, with exchange enrollment having been weaker than many insurers and hospitals expected, hospitals’ ‘post-exchange’ pricing leverage also is weaker. More simply, before the exchange roll-out high profile hospitals could argue to an insurer that their presence in exchange networks was necessary for the insurer to attract beneficiaries in the initial ‘land grab’ of enrollment; now that the initial period has passed and no real land-grab materialized, hospitals have lost the related negotiating leverage. Thus the rate of growth in commercial ‘list’ pricing is likely to slow

Underneath a (likely) slowing commercial list pricing trend is an accelerating collections headwind. As commercial forms of insurance have become less generous, patients have become responsible for larger percentages of their hospital charges. And, as patients’ share of hospital bills has risen, their willingness to pay has fallen (Exhibit 1, again)

As Employers Shift to Private Exchanges, Average Actuarial Values Fall, and Collections Risks Grow Further

Regardless of whether and to what degree the public exchanges succeed, we believe private health insurance exchanges are likely to become the standard for employer sponsored insurance. As employees shift to private exchanges, their choice of insurance presumably will broaden to include options that are less generous than what they currently have. As this shift occurs, we see the potential for the average actuarial value[5] of employer-sponsored coverage to decline from the current 82 average, to (or at least toward) an enrollment-weighted average of 65. This in turn makes the typical employer-sponsored beneficiary responsible for a higher percentage of allowed charges (18 percent in the case of an 82AV plan; 35 percent in the case of a 65AV plan), making hospitals’ net collections that much worse

Finding the Right Balance – A Model of Hospitals’ Collections Risks

This begs the question of which trend is more impactful – the improvement in hospitals’ collections as the number of uninsured persons falls; or, the worsening of hospitals’ collections as the generosity of commercial insurance (mainly employer-sponsored health insurance) also falls

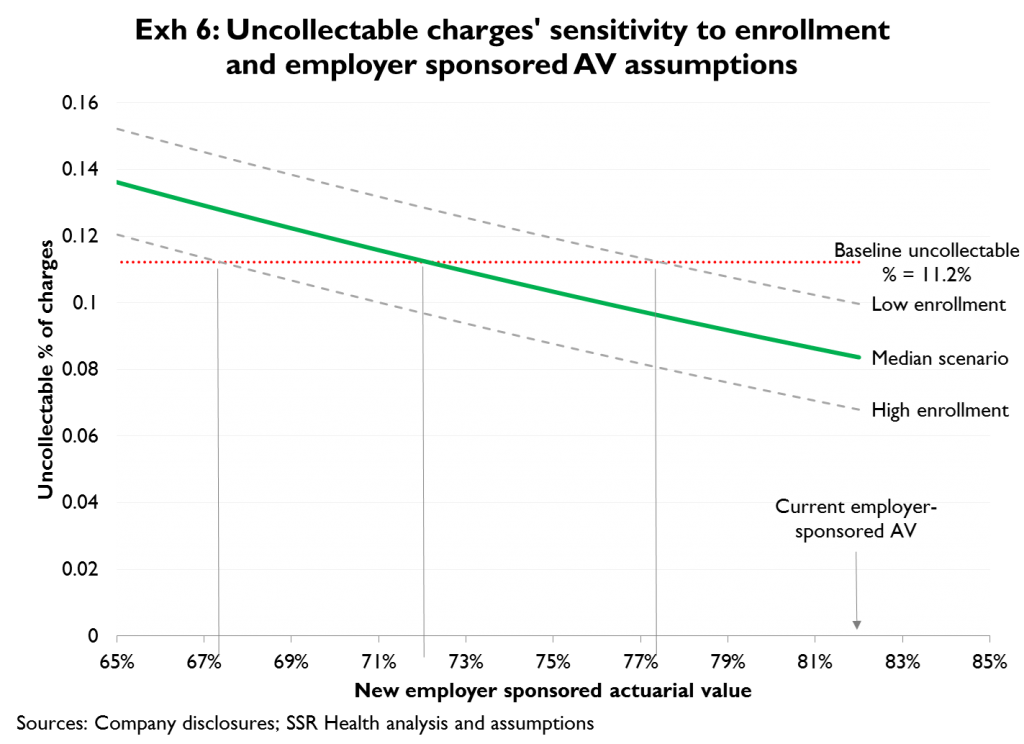

We developed a model of hospitals’ ‘collections leverage’, using HCA’s payor mix, informed estimates of patients’ share of charges (by payor), and informed estimates of hospitals’ collection rates on patients’ share of charges (again, by payor). At baseline, our collections leverage model indicates a provision for doubtful accounts equal to 11.2 percent of net[6] hospital revenues, which is equal to the provision reported by HCA for 2013

We examined how the provision for doubtful accounts would change as a function of two categories of assumptions: 1) reduction in the number of uninsured as Medicaid expands and enrollment on the public health insurance exchanges grows; and 2) changes (declines) in the average actuarial value of employer sponsored health insurance. We assume that the number of uninsured persons falls according to any of three (low, median, high) potential scenarios. The low scenario assumes a Medicaid eligibility expansion across most states to 100 percent of the federal poverty level (100FPL)[7], and a net gain of 3M individually-insured beneficiaries on the health insurance exchanges (HIEs). The high scenario assumes all states expand Medicaid eligibility to 138FPL, and a net gain of 20M beneficiaries on the HIEs. The median scenario takes the midpoint of both the Medicaid expansion and HIE enrollment assumptions. As regards employer sponsored insurance, we examined how the provision for doubtful accounts would change as the average actuarial value of coverage fell from the current value of 82 to a potential average of 65. Consistent with the evidence in Exhibit 1, we assumed hospitals’ collection rate on insured patients’ share of charges would fall as patients became responsible for a higher percentage of charges, i.e. as actuarial values fell. Specifically, we assumed hospitals are currently collecting 55 percent of these insured patients’ share of charges at the prevailing 82 actuarial value average, and that the collection rate would fall to 45 percent as the average actuarial value fell to 65

Exhibit 6 summarizes the results. The x-axis corresponds to the average actuarial value of employer sponsored health insurance; the y-axis indicates our estimate of hospitals’ uncollectable charges under various assumptions. The horizontal red line marks the current (for HCA) level of doubtful accounts as a percent of net revenues. The three angled lines represent the low (upper line), median (middle line) and high (bottom line) enrollment scenarios for Medicaid and the public HIEs

The low enrollment scenario generally reflects the Medicaid expansion and public HIE enrollment gains we expect in 2014. Thus if there were no erosion in the average AV of employer-sponsored coverage, we might expect hospitals’ provision for doubtful accounts to fall from 11.2 percent to roughly 10.0 percent as the result of falling numbers of uninsured. And/or, we could argue that the falling numbers of uninsured in 2014 are enough to cover the effects of the average AV of employer-sponsored insurance falling from 82 to roughly 78

We view the median enrollment scenario as the most realistic – barring major policy changes that might occur to make the public HIEs more successful. Under this scenario the numbers of uninsured fall far enough to allow the average AV of employer sponsored insurance to fall from 82 to 72 (just a bit more generous than an HIE-based ‘Silver’ plan) without negatively affecting the percentage of hospitals’ revenues that are uncollectable

Under the high enrollment scenario (all states expand Medicaid to 138FPL and the HIEs register a net gain of 20M insured), the average AV of employer-sponsored insurance could fall to as low as roughly 67 without causing a rise in hospitals’ provision for doubtful accounts

[1] Hospitals’ hourly workers do not produce inventory, rather they provide care that is immediately consumed, thus hours worked correlates well with actual unit demand for hospital services

[2] The Congressional Budget Office has projected 2014 net Medicaid enrollment gains of 8M, and the administration has touted 8-9M determinations of Medicaid eligibility since October. However, Avalere Health has estimated that only 2.4-3.5M of those determinations represent people who have newly registered for the program under the ACA

[3] Recently released enrollment figures of 4M persons include persons who have not paid premiums, and persons who were previously insured. As of yet we have no means of accurately quantifying net enrollment gains

[4] “Hospitals’ Stable to Improving Net Pricing Power”, SSR Health, January 24th, 2012. We argued that because potential enrollees seeking coverage on the health insurance exchanges are more likely to recognize local hospitals’ brand names than the brand names of insurers, that insurers need ‘high name recognition’ hospitals in their exchange networks – at least during the initial enrollment period(s)

[5] Actuarial value of ‘AV’ refers to the percentage of allowed charges paid for by the insurer. For example, an 82AV plan would pay 82 percent of allowed charges

[6] Before the provision for doubtful accounts

[7] At present, some states have expanded Medicaid eligibility fully to 138FPL, other states have not expanded eligibility at all. Over time, we see all states at or near 100FPL as a natural equilibrium, as this eligibility threshold appears to be in states’ best economic interests. This is in large part because persons at 101 to 138FPL are eligible for federally-subsidized coverage on the HIEs at no cost to the states