Background

Product pipelines account for a large percentage of drug and biotech companies’ total values, however relatively little information about pipeline products is available through traditional sources. As a result, the portion of share price attributable to pipelines is inherently noisy

Companies’ patenting efforts are consistent, thorough, and applied to projects at very early phases of development; because of this patent data offer an objective means of comparing companies’ mid- to early-stage[1] research pipelines

We map US patents and patent applications to the publicly-traded drug and biotech companies, then set aside patents that are associated with marketed or late-stage[2] products, leaving just the patents associated with phase 2 and earlier projects[3]. We then quality-adjust these patents; the resulting number of quality-adjusted patents is an index of the size and quality of companies’ mid- to early-stage pipelines

To estimate the market value assigned to each company’s phase 2 and earlier pipeline, we subtract from each company’s enterprise value the summed net present value of all products that are either on-market, filed for regulatory approval, or in phase 3 clinical testing. For companies with non-pharma / non-biotech lines of business, we also subtract an estimate of the market capitalization of these businesses from the companies’ enterprise values

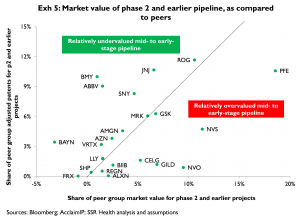

We then compare the apparent value the market assigns to each company’s phase 2 and earlier pipeline to the number of quality-adjusted patents that company has for phase 2 and earlier projects. Companies with large quality-adjusted patent counts but low pipeline market values presumably are undervalued, and vice versa

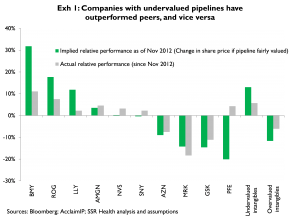

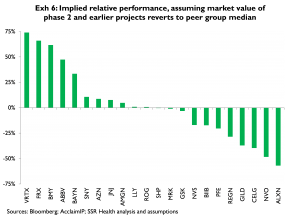

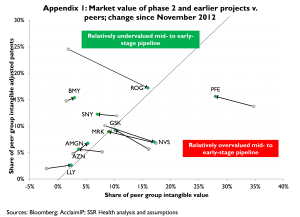

We first applied this method in November of 2012; among other outputs we calculated the relative share price performance of a given company versus its peers if its phase 2 and earlier pipeline was to be valued on par with peers, a value we called ‘implied relative performance’

Exhibit 1 (cover) compares the implied relative performance values we published in November of 2012 with actual relative performances since then. All five of the stocks with positive implied performance outperformed their peers (average outperformance 5.7 pct); three of the five stocks with implied underperformance underperformed their peers (average underperformance 6.1 pct)

Pipelines: Relative Value

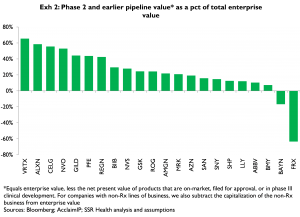

Exhibit 2 summarizes the apparent values of phase 2 and earlier pipelines[4] as a percent of each company’s total enterprise value, for an expanded set of drug and biotech companies

Because the market has had no objective and thorough basis for comparing companies’ mid- to early pipelines, these large percentages of market values are inherently noisy estimates. As mid- to early-phase projects mature, the characteristics of the underlying products become better known, and the market’s noisy estimates of these projects’ values should normalize, implying correspondingly large impacts on relative share price performance

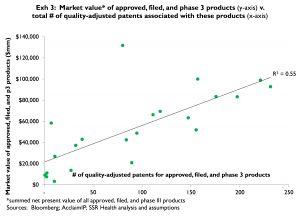

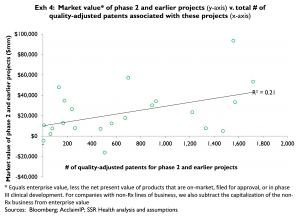

As a supporting observation, the apparent market value of on-market, filed, and phase 3 projects appears at least somewhat related to the number of quality-adjusted patents associated with these late-stage assets (Exhibit 3). In contrast, the apparent market value of phase 2 and earlier projects appears unrelated to the number of quality-adjusted patents associated with these projects (Exhibit 4)

Exhibit 5 sorts companies into those with apparently under- or overvalued phase 2 and earlier pipelines. The x-axis indicates the apparent market capitalization of each company’s phase 2 and earlier pipeline as a percentage of the total apparent market capitalization for all companies’ phase 2 and earlier pipelines. For example, the apparent market value of MRK’s mid- to early pipeline is about 6 pct of the combined market value for all of the phase 2 and earlier pipelines for all 22 companies analyzed. The y-axis indicates each company’s quality-adjusted patent counts for phase 2 and earlier projects, as a percent of the total count of quality-adjusted patents for all 22 companies analyzed. Again for example, MRK’s portfolio of quality-adjusted patents for projects in phase 2 and earlier development represents about 6 pct of the total count of quality-adjusted patents for all 22 companies analyzed. Because MRK has both 6 pct of the group’s quality-adjusted patents and 6 pct of the total market value assigned to the groups’ phase 2 and earlier pipelines, we conclude MRK’s mid- to early pipeline is valued at par[5]. In contrast, BMY has a much higher share of the comparison group’s quality-adjusted patents than of the group’s total (pipeline) market value, thus BMY’s pipeline appears relatively undervalued. At the opposite extreme, PFE has a much larger share of the group’s pipeline market value than of the group’s quality-adjusted patents, implying PFE’s pipeline is relatively overvalued. A version of Exhibit 5 published in November 2012, showing shifts in each company’s position on these measures since that time, is provided as Appendix 1

Exhibit 6 sorts companies according to our updated estimate of ‘implied relative performance’, which is the relative performance that would occur if a given company’s phase 2 and earlier pipeline (as characterized by the associated quality-adjusted patents) were valued at par with the peer group average. Of the larger names BMY, ABBV, Bayer and SNY all have implied relative (out-) performance values of more than ten percent; and, NVO, PFE, and NVS all have implied relative (under-)performance values of more than negative ten percent

Our method of quality-adjusting patents relies heavily on citation weighting, i.e. the more frequently a patent is cited by future patents, the more heavily that patent is weighted in our ‘count’ of quality-adjusted patents. Citation weighting is a reasonably well proven means of quality (or value) adjusting patents, and is a dramatic improvement over simple raw patent counts; however we recognize citation weighting has its limits. To improve on simple citation weighting, we also take into consideration factors such as rate and ‘vintage’. For example, how rapidly a patent accumulates citations is more important than the patent’s raw number of citations. And, the ‘benchmark rate’ of citation accumulation is somewhat dependent on when the patent was issued, since patents of a given ‘vintage’ tend to accumulate citations more or less rapidly than patents of preceding or subsequent vintage. More obviously with respect to vintage, older patents that are closer to expiry offer less apparent value; the underlying protections are short-lived, and the odds of +/- 15 y.o. patent representing a mid- to early-phase breakthrough are relatively low

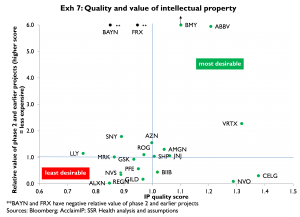

Exhibit 7 (following page) compares the relative market value of a company’s phase 2 and earlier pipeline with a quality index for that company’s phase 2 and earlier patents. The y-axis is an index of relative value; a value of 1.0 implies that the market value of a quality-adjusted phase 2 and earlier project is at par. The x-axis is a composite quality index reflecting age and citation accumulation rate (younger and faster is better). For example, this analysis shows that in addition to having pipelines that appear undervalued versus peers, the projects in BMY, ABBV, and VRTX’s (phase 2 and earlier) pipelines appear to be of higher quality than peers’. In contrast, Bayer and FRX appear to have pipelines that also are apparently undervalued versus peers, however their pipelines appear to be of lower quality than peers’

Among the larger cap names, these results imply long or overweight positions in BMY and ABBV, and short or underweight positions in PFE and NVS. SNY screens as having a relatively large (11 pct) implied positive performance (Exhibit 6); however it has a substantially lower average quality score (Exhibit 7) thus our decision not to rate SNY positively. NVO screens as having a large negative implied performance (Exhibit 6); however it also has a substantially higher average quality score than peers (Exhibit 7), thus our decision not to rate NVO negatively

R&D: Comparative Productivity

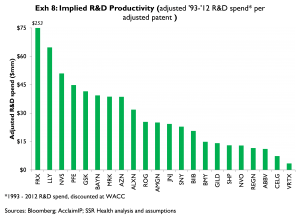

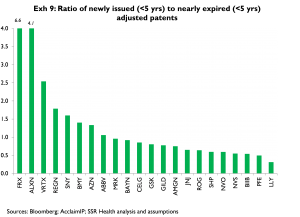

Quality-adjusted patent data offer two useful comparative indices of R&D productivity: R&D dollars spent per quality-adjusted patent, and the relative rates of new patent formation and old patent expiry

Exhibit 8 compares each company’s cumulative R&D spending from 1993 to 2011 to the number of quality-adjusted patents produced during that period (unlike the preceding analyses which focus mainly on patents relating to companies’ phase 2 and earlier projects, we consider all quality-adjusted patents in Exhibit 8). On this measure, among the larger companies LLY, NVS, and PFE have been the least productive; BMY, NVO, and ABBV have been the most productive

As an index of the relative rates of formation and expiry for quality-adjusted patents, Exhibit 9 shows the ratio of the number of patents issued in the last 5 years to the number with 5 or fewer years of exclusivity remaining. On this measure, among the larger companies LLY, PFE, and NVS are again the least productive; NVO, BMY, and ABBV are again the most productive, joined in this case by AZN

[1] We arbitrarily define mid- to early-stage as phase 2 and earlier projects

[2] Either filed for approval or in phase 3 clinical testing

[3] In truth, the remainder also includes patents for products that have failed at various phases of development. We control for this in part by adjusting patent values for age

[4] Equals enterprise value, less the summed net present value of on-market, filed for approval, and phase 3 products. For companies with non-pharma / non-biotech lines of business, we estimate the market cap of these other lines of business (generally using sales multiples), and also subtract this from enterprise value

[5] This is obviously a relative measure – in this context we’re making no claims as to whether these values are high or low in the absolute